irs tax levy program

The federal agency you were working for gets its money from the Treasury and the Treasury can simply take the payments you are supposed to receive in order to offset the debt. A tax levy is when the IRS seizes your property and uses it to apply toward your debt.

Irs Notice Cp523 Understanding Irs Notice Cp 523 Intent To Terminate Your Installment Agreement Seize Your Assets Pending

However taxpayers should file any.

. It can garnish wages take money in your bank or other financial account seize and sell your vehicle. You May Qualify For An IRS Hardship Program If You Live In New York. Ad Call The Nations Most Experienced IRS Levy Expert.

Federal Payment Levy Program FPLP attaches to federal disbursements due an individual or business such as retirement vendorcontractor payments and social security Alaska. IRS has the authority to seize property to collect outstanding debt owed to the US. IRS will send you a notice prior to levying the.

Unlike the IRS tax levy program described in GN 02410100 the FPLP is an automated system that does not require the Social Security Administration SSA to take any. The IRS offers several solutions for people who cannot afford to pay their full sum of back taxes. Avoid Bogus Review Sites And Scams.

You fail to remit payment as ordered after receiving this. 28 Yrs Exp CPA MS Tax Ex-IRS Agent. Review Comes With No Obligation.

You are sent a tax bill titled Notice and Demand for Payment. Ad Call The Nations Most Experienced IRS Levy Expert. The IRS will often levy a bank account meaning they can freeze your accounts and take your money.

You have an unpaid tax debt and the IRS has issued a levy which is a legal seizure of your property or assets. You paid the amount you owe The period for collection ended prior to the levy being issued Releasing the levy will help. Trusted Reliable Experts.

Start Your Free Trial IRS Levy Relief Help Here Today. See if you Qualify for IRS Fresh Start Request Online. Owe IRS 10K-110K Back Taxes Check Eligibility.

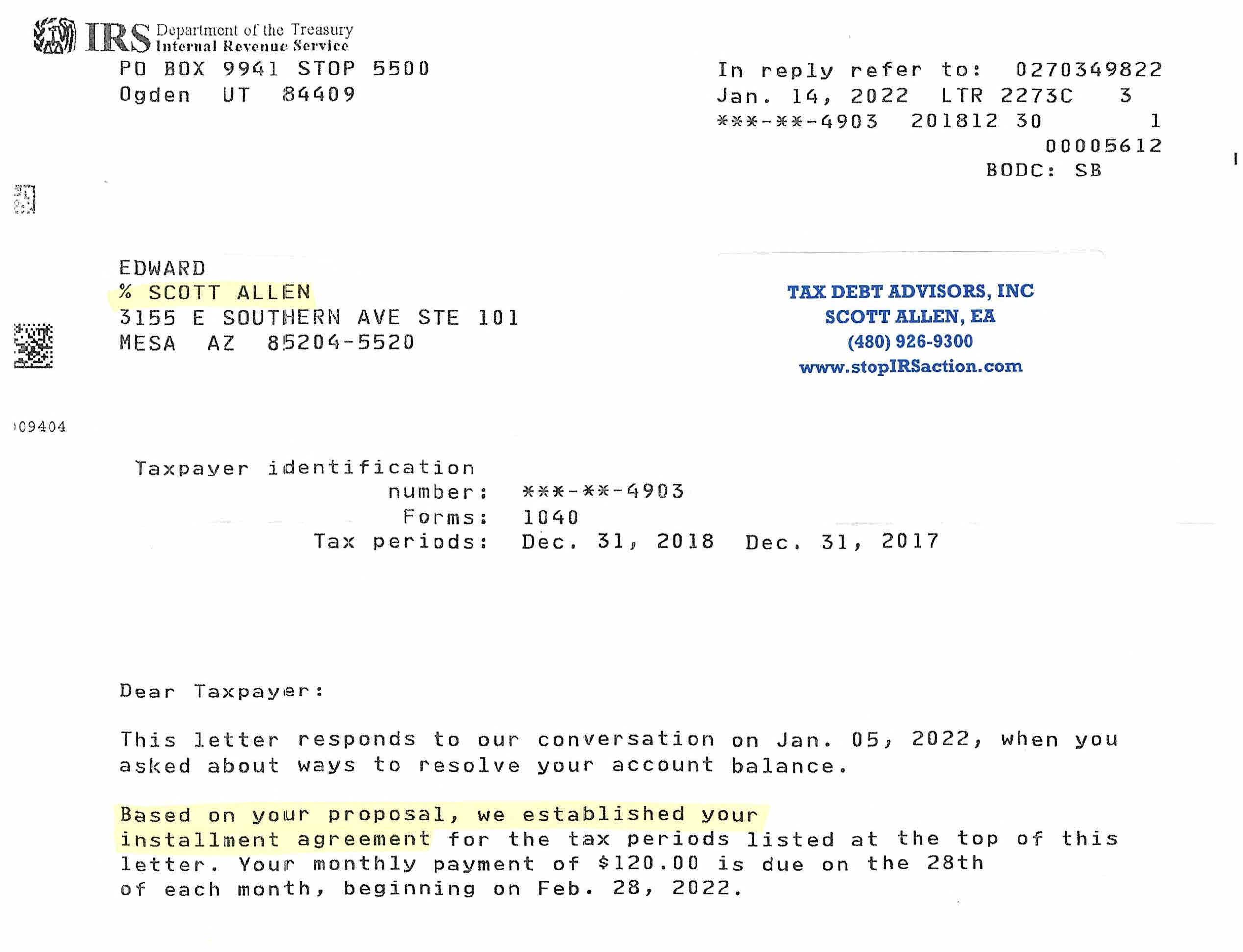

For individual taxpayers receiving notices letters about a tax bill with tax liabilities up to 250000 for Tax Year 2019 only the IRS can offer one Installment Agreement. Ad As Seen On TV Radio. This authority is covered in 26 USC.

Delinquent Return Filings - The IRS will not default an OIC for those taxpayers who are delinquent in filing their tax return for tax year 2018. If you require face-to-face service at the Buffalo IRS office you must call 844-545-5640 to schedule an appointment. The Federal Payment Levy Program FPLP is an automated system the IRS uses to match its records against those of the governments Bureau of the Fiscal Service BFS to identify.

Ad Owe back tax 10K-200K. Under this program the IRS can generally take up to 15 percent of your federal payments including Social Security or up to 100 percent of payments due to a vendor for. Ad Remove IRS State Tax Levies.

A tax levy can involve garnishing wages or seizing assets. The IRS can levy your personal property investments and real estate. Ad Use our tax forgiveness calculator to estimate potential relief available.

This program matches federal tax delinquent accounts against a database of Alaskan residents eligible to receive the dividend. Once you make an appointment you will. 6323 6331-6335 6338 6339 and 26 CFR.

A tax levy is the seizure of property to pay taxes owed. Social Security Benefits Eligible for the Federal Payment Levy Program Beginning in February 2002 Social Security benefits paid under Title II - Federal Old-Age Survivors and Disability. The Federal Payment Levy Program FPLP is an automated levy program the IRS has implemented with the Department of the Treasury Bureau of the Fiscal Service BFS since.

How to make an appointment. In addition to free resources CommunityTax offers a 39 per month program called the Community Tax Assurance Program TAP. The IRS is required to release a levy if it determines that.

The Treasury Offset Program TOP collects past-due delinquent debts for example child support payments that people owe to state and federal agencies. Tax Relief Help 2022 Top Brands Comparison Online Offer. Ad Take 60 Seconds To See If You Qualify For A Free Expert Tax Relief Consultation.

The program includes access to a. Get Your Free Tax Review. It is different from a lien while a lien makes a claim to your assets.

No Fee Unless We Can Help. 28 Yrs Exp CPA MS Tax Ex-IRS Agent. An IRS levy permits the legal seizure of your property to satisfy a tax debt.

Personal property is traditionally defined as moveable property and includes items such as your car boat. Avoid Bogus Review Sites And Scams. Some items cant be seized.

If you do not resolve your tax bills on time we may proceed with the following collections actions. Solve Your IRS Debt Problems. The 1997 Taxpayer Relief Act authorizes the Internal Revenue Service IRS to collect overdue federal tax debts of individuals and businesses that receive federal payments by levying up to.

We provide Immediate IRS Help to Stop Wage Garnishment and End Your Tax Problems. Start Your Free Trial IRS Levy Relief Help Here Today. Ad Dont Waste Money and Time Fighting the IRS Alone - Choose the Best Tax Relief Services.

On a general note each IRS tax forgiveness program considers the following factors. The IRS only issues a levy order after taking three steps.

Wage Garnishment Or Tax Levy On Taxes Owed Irs Tax Lien

Wage Garnishment Or Tax Levy On Taxes Owed Irs Tax Lien

Wage Garnishment Or Tax Levy On Taxes Owed Irs Tax Lien

Irs Bank Levy Tax Center Usa Tax Problem Relief

5 19 9 Automated Levy Programs Internal Revenue Service

Irs Just Sent Me A Notice Of Intent To Levy Intent To Terminate Your Installment Agreement Cp 523 What Should I Do Legacy Tax Resolution Services

Irs Notice Cp90 Final Notice Of Intent To Levy And Your Right To A Hearing H R Block

Irs Just Sent Me A Notice Of Intent To Seize Levy Your Property Or Right To Property Cp 504 What Should I Do Legacy Tax Resolution Services

Wage Garnishment Or Tax Levy On Taxes Owed Irs Tax Lien

Irs Tax Letters Explained Landmark Tax Group

Irs Help By City Tax Debt Advisors

Wage Garnishment Or Tax Levy On Taxes Owed Irs Tax Lien

Overview Of The Treasury Department S Federal Payment Levy And Treasury Offset Programs Everycrsreport Com

Irs Cp 508c Notice Of Certification Of Your Seriously Delinquent Federal Tax Debt To The State Department

Irs Letter 1058 Or Lt11 Final Notice Of Intent To Levy H R Block

5 11 7 Automated Levy Programs Internal Revenue Service

Irs Cp504 Notice Of Intent To Levy What You Should Do